![]()

When starting a business or contemplating a significant investment, the first consideration is which entity should be used for the ownership of that business/investment.

Traditionally, a common structure for private businesses was a discretionary trust. In the current tax environment, we find a standard recommendation of many advisers (in some cases, to all clients) is a company owned by a discretionary trust.

Is this a suitable structure recommendation?

What has changed?

Division 7A contains a group of provisions that tax loans by private companies as unfranked dividends unless there are annual repayments over a seven year period (or 25 years if sufficient real estate security is provided).

Under the traditional structure of a discretionary trust, it was accepted that trust income could be taxed at the company tax rate by making distributions to a private company beneficiary that was not paid.

Prior to December 2009, the ATO accepted that unpaid distributions were not loans and were not required to be repaid within a stipulated period. The ATO changed its view in December 2009 and considered unpaid distributions were financial accommodation and within the extended meaning of loan.

Key structure factors

The key factors that are sought for a desirable structure are:

- Rate of tax not significantly more than the company tax rate;

- Protection of assets in the event of a claim against equity owners;

- Limited liability;

- Allows introduction of new equity participants;

- Maximum entitlement to CGT concessions (50% CGT discount and small business CGT concessions);

- Income splitting and distribution flexibility;

- Tax preferences can pass to beneficiaries/members without additional tax;

- Not subject to Division 7A.

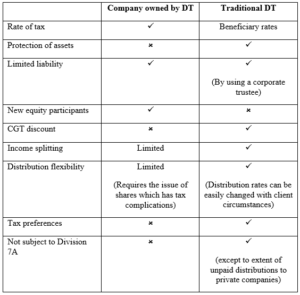

So how do each of the structure alternatives 1. Company owned by a Discretionary Trust (DT) Traditional Discretionary Trust, compare on our key structure factors?

The clear point from the above table is trusts are the preferred vehicle for capital appreciating assets (including goodwill of a business), and the only advantage of a company structure is the rate of tax and the introduction of new equity participants. However, that advantage is only relevant if funds are required for working capital. Small trading companies (referred to as base rate entities) are taxed at 27.5%, and other companies at 30%.

The effect of the change in the ATO view is that trust income must generally be distributed and taxed to natural persons. The tax rates that apply to natural persons is at a taxable income of $90,000 a marginal rate of 34.5% (less the low and middle income tax offset), but lower rates for income below $37,000. To draw a comparison with the company rates, a natural person has an average rate of tax (at 2018/2019 rates) of 27.5% for income of $108,722, and 30% for income of $138,922.

Structure Recommendation

In the case of a couple (husband and wife, defactos, same-sex couples), there is little advantage for incomes up to $217,444 ($108,722 x 2).

The income generated from a business may be considered to fall within three separate phases:

- initial start-up, at which time the income may be personal services income and not able to be split;

- income is no longer considered personal services income, is considered business income below the threshold in the previous paragraph $217,444;

- the business is generating income above those thresholds.

Since the preferred vehicle for holding capital appreciating assets is a trust, it will usually be preferable to own the business through a trust structure. When the level of income reaches the point where the company tax rate is desirable, the structure should then be split between capital ownership in a trust and income generation in a company.

In that light, a better option is a structure which evolves through the three phases in the following manner:

- structure at start-up is in the form of a discretionary trust even if income generated is personal services income. This approach avoids having to restructure the business when it reaches phase 2;

- when the business moves to phase 2, no change to the structure is required to split income;

- when the business moves to phase 3, split the structure between capital ownership in a trust and income ownership in a company. The splitting can be implemented with an appropriate Licence Agreement between the trust (asset owner) and an operating company, drafted in such a manner that does not trigger tax on the grant of the licence. Alternatively, rollovers can be utilised to restructure into a corporate entity, when and if the business reaches this phase.

By Domenic Festa (Accredited Tax Specialist and Chartered Tax Adviser)

NOTE: This article is for general information only and should not be relied upon without first seeking advice from one of our specialist solicitors.