The ATO has had on its radar what it describes as stapled structures. It has identified a number of concerns that it has with stapled structures. Then in the May 2018 budget, the Government announced amendments to the law to address some of the concerns.

In its Taxpayer Alert (TA 2017/1: Re-characterisation of income from trading businesses), the ATO identified four different kinds stapled structure arrangements. Each of those have similarities to structures that are commonly implemented by private business.

This article considers whether the ATO concerns apply to private business.

The kinds of staples identified by the ATO (in order of relevance to the private business) are: Royalty Staple, Rental Staple, Finance Staple, and Synthetic Equity Staple.

Further details in respect of each of the staple arrangements, and how they are similar to private business structures are:

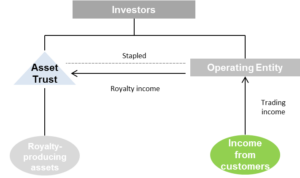

Royalty Staple

Key Features:

- Asset Trust holds assets such as intellectual property, industrial equipment, or other assets of a busines

- Operating Entity pays a royalty to Asset Trust for use of the assets

- Operating Entity claims a tax deduction for the payments made to Asset Trust

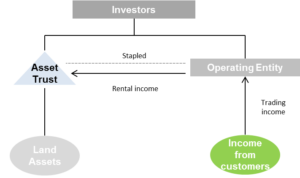

Rental Staple

Key Features:

- Asset Trust owns land and fixtures on land (e.g. business premises)

- Operating Entity enters into one or more lease agreements with Asset Trust for lease of the premises

- Operating Entity claims a tax deduction for the payments made to Asset Trust

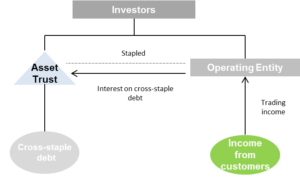

Finance Staple

Key Features:

- Operating Entity carries on a business usually with external debt

- Operating Entity carries much less than the expected level of equity

- Asset Trust receives trust equity from the investors as beneficiaries

- Asset Trust’s equity is lent to Operating Entity at interest

- Operating Entity claims a tax deduction for the interest payments

- The interest is usually distributed to the investors

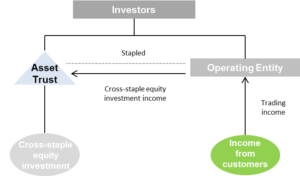

Synthetic Equity Staple

Key Features:

- Asset Trust and Operating Entity enter into an arrangement under which the Operating Entity pays:

- profit-equivalent amounts to Asset Trust-

- turnover-equivalent amounts to Asset Trust, and/or

- amounts which have a similar result as the above.

- Operating Entity claims a tax deduction for the payments made to Asset Trust

Each of the above staples have some equivalents to structures ordinarily implemented by private business entities as follows:

- Royalty Staple – License arrangements for a business;

- Rental Staple – lease of business premises;

- Finance Staple -inter-entity loans;

- Synthetic Equity Staple – license arrangements and certain kinds of joint venture agreements.

However, it seems clear from the Alert that the ATO’s key concern is where stapled structures are used with foreign investors, and the stapled structure converts income that would have otherwise been trading income in a corporate entity into more concessionally taxed passive income derived by a trust (in particular, an MIT). For foreign investors, trading income in a corporate entity is taxed as fully franked dividends at 30%, but passive income flowing through a trust is taxed at much lower rates applying to interest and royalties. Their main focus of attack is that the trust is not an MIT but rather taxed as a public trading trust, which prevents income from being concessional passive income.

Effect on Private Business Structures

Most private business structures are owned and controlled by Australian residents. The issue of concern with the ATO of the tax benefits to foreign investors from stapled structures do not arise for Australian residents in private business entities.

The ATO acknowledges that traditional stapled structures have been used in the tax system for many years and are accepted where they do not exhibit the above issues involving foreign investors.

However, they also note that stapled structures of the ordinary kind have general tax compliance issues to satisfy in their implementation. It is therefore necessary to ensure proper implementation with effective documentation.

By Domenic Festa (Accredited Tax Specialist and Chartered Tax Adviser)